On 24 September 2020, Rishi Sunak announced further measures to aid businesses going into the winter months including the new Job Support Scheme.

The Job Support Scheme will commence on 1 November 2020 and replaces the Coronavirus Job Retention Scheme, or “furlough” scheme as it is sometimes referred to, which is due to end on 31 October 2020.

The new Job Support Scheme is designed to help businesses who are facing a lower demand over the winter months due to the impact of Covid-19. It is scheduled to run until 30 April 2021.

The new scheme will operate as follows:

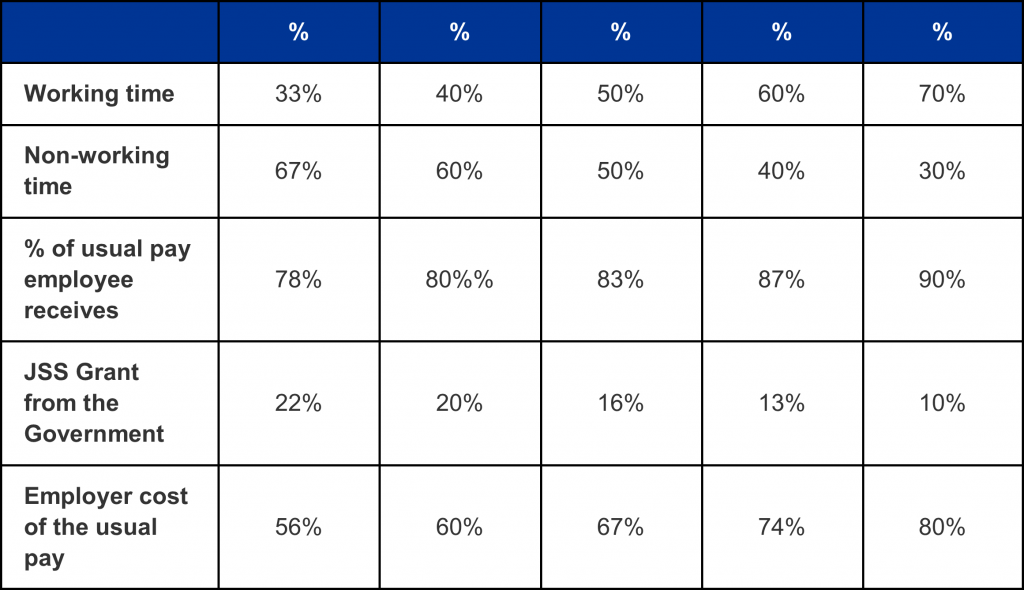

- Employees must work for at least a third (33%) of their usual hours and be paid for these hours by their employer in the ordinary way.

- Employers must also have to pay the employee for two-thirds (67%) of the rest of the usual hours that an employee would have worked. Half of this payment for unworked hours (subject to the cap) could then be reclaimed from the government via an online portal in a similar way to the Coronavirus Job Retention Scheme.

- The Government’s contribution per employee will be subject to a cap of £697.92 a month.

- Employers will be responsible for all national insurance and pension contributions, including in respect of the government’s contribution towards an employee’s pay for unworked hours.

- To be eligible, employees must have been on the employer’s payroll on or before 23 September 2020.

- Large employers will have to meet a financial assessment test to be eligible for grants under the JSS and it will only be available to those large employers where turnover is lower now than before experiencing difficulties due to Covid-19.

- SMEs will not be subject to a financial assessment test.

The scheme is scheduled to last for 6 months and is expected to vary in this period to adapt to continuing changes in economic activity. Further information can also be found in this Government Factsheet.

For more information or advice for your business, please contact a member of our specialist employment law team by contacting them directly. You can also call us on 0115 9 100 200 or click here to send an email.

Posted on October 6, 2020